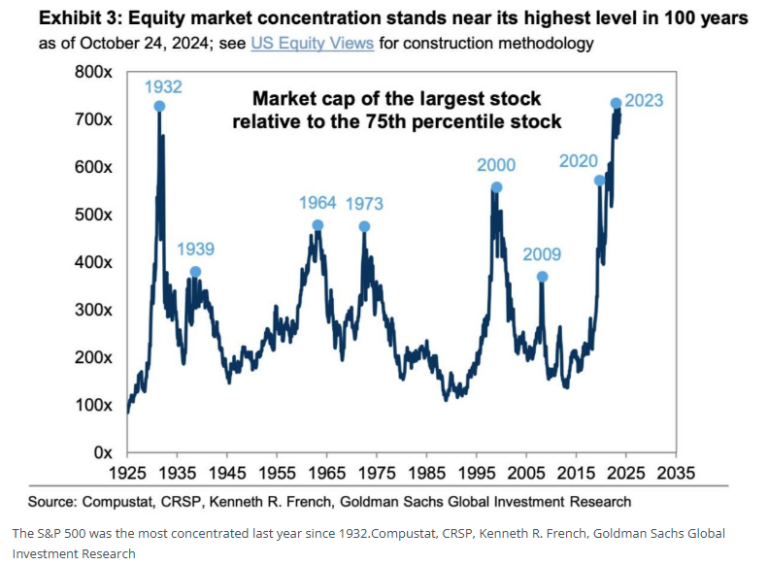

This Business Insider article highlights 4 charts Goldman Sachs is watching as it predicts an era of weak stock returns ahead, one of which uses CRSP data to highlight a century-high market concentration of the S&P500.

Read the full article.

The difference is clear.

©2025 Center for Research in Security Prices, LLC. All Rights Reserved. | Policies & Statements | Privacy Policy