Concurrent with the December quarterly ranking period, the Center for Research in Security Prices (CRSP) is announcing the expansion of its CRSP Market Index (CRSPMI) product suite with the introduction of five new indexes, designed in accordance with the innovative and distinctive CRSPMI methodology, to provide investors with additional benchmarks for the U.S. equity market. The following table shows the new index products and their symbology.

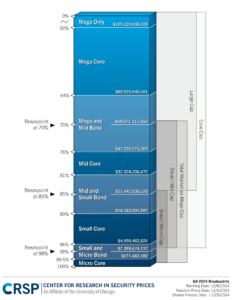

At the center of this offering is a new index called Core Cap. Core Cap will be based off of the flagship CRSP Total Market Index, but exclude the constituents of micro capitalization companies. In doing so, CRSPMI will provide a new index series, with commensurate Value and Growth benchmarks, specifically designed to represent 98% of the investable capitalization of the U.S. market, without the least-traded, more volatile and lowest-capitalization equities in the marketplace. CRSPMI views the Core Cap offering as a key product enhancement and alternative to other existing indexes which rely on constituent count-based schemes.