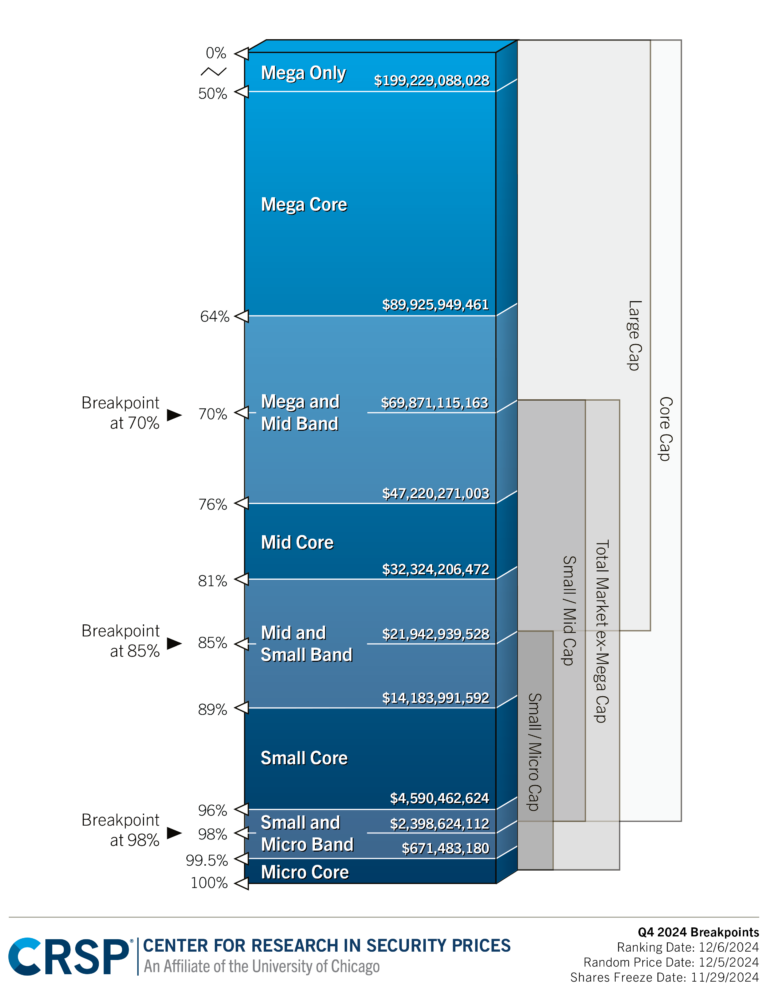

CRSP Market Indexes (CRSPMI) announces the market cap breakpoints and effective ranking dates for its December 2024 quarterly index rebalancing.

To view the full chart, click here.

CRSP Market Indexes (CRSPMI) announces the market cap breakpoints and effective ranking dates for its December 2024 quarterly index rebalancing.

To view the full chart, click here.

As communicated previously, CRSP is migrating to a new back office. This requires that subscribers migrate to the Stock & Indexes Flat File Format 2.0 (CIZ), which was made available in summer 2022. The December 2024 data which will be released in January 2025, is scheduled to be the last release of datasets produced in the Legacy (FIZ) and Flat File Format 1.0 (SIZ) formats. Subscribers may refer to several documents to become familiar with the Flat File Format 2.0 (CIZ) files.

In The Picker’s Penance, CRSP data analyzes the long-term results of active stock-picking strategies. The article explores challenges investors face in consistently outperforming the market, with CRSP’s reliable datasets offering

Using CRSP Market Indexes Methodology, CRSP Count™ tracks changes in the number of securities by market cap segments – Mega, Mid, Small and Micro – through time.

©2024 CENTER FOR RESEARCH IN SECURITY PRICES, LLC. ALL RIGHTS RESERVED.