CRSP IPO Report Q3 2024

CRSP US Total Market Index includes most of the new IPOs within five trading days of listing. This new report looks at the trends in IPOs and their impact on CRSP Market Indexes.

CRSP developed and maintains Sector Indexes for all stocks included in the CRSP US Total Market Index segmented by the business characteristics of each issuing company. CRSP uses ICE Uniform Entity Sectors (UES) codes to assign issuing companies and their stock to the appropriate sector.

Money managers and other practitioners use multiple metrics to identify and measure investment styles – Value and Growth. CRSP scores each security and determines its weight in the appropriate Value index using the following factors:

CRSP US Total Market Index includes most of the new IPOs within five trading days of listing. This new report looks at the trends in IPOs and their impact on CRSP Market Indexes.

Notable items with this release include:

– November was a great month for all cap segments, but smaller companies look to have taken the spotlight.

– All Sectors had positive returns, with Consumer Discretionary leading the pack at 12.63%.

– Micro’s recent out performance has brought its 12 month cumulative returns to the top of all the cap segments

– Growth outperformed value counterparts across the board.

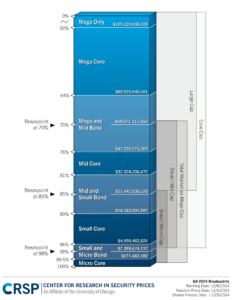

CRSP Market Indexes (CRSPMI) announces the market cap breakpoints and effective ranking dates for its December 2024 quarterly index rebalancing. To view the full chart, click here.

©2025 CENTER FOR RESEARCH IN SECURITY PRICES, LLC. ALL RIGHTS RESERVED.