“Vanguard’s Total Stock Market Fund, at $1.3 trillion in assets, is a market unto itself – powered by an unassuming index called CRSP.”

Read the full article at the Wall Street Journal.

“Vanguard’s Total Stock Market Fund, at $1.3 trillion in assets, is a market unto itself – powered by an unassuming index called CRSP.”

Read the full article at the Wall Street Journal.

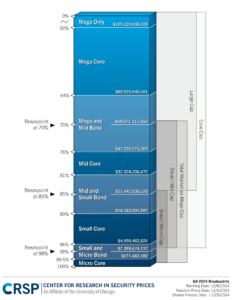

CRSP Market Indexes (CRSPMI) announces the market cap breakpoints and effective ranking dates for its December 2024 quarterly index rebalancing. To view the full chart, click here.

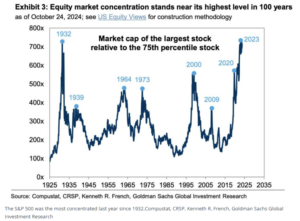

This Business Insider article highlights 4 charts Goldman Sachs is watching as it predicts an era of weak stock returns ahead, one of which uses CRSP data to highlight a

In a recent Middle Market article, NPM’s new product shows how demand for transparency in private trading data is transforming market insights. CRSP data reveals shifts in public listings and

©2025 CENTER FOR RESEARCH IN SECURITY PRICES, LLC. ALL RIGHTS RESERVED.