CRSP Has Moved!

As of Monday, April 7, 2025, CRSP offices are now located at:

500 W Madison St, Ste 2900

Chicago, IL 60661

Money managers and other practitioners use multiple metrics to identify and measure investment styles – Value and Growth. CRSP scores each security and determines its weight in the appropriate Value index using the following factors:

CRSP developed and maintains Sector Indexes for all stocks included in the CRSP US Total Market Index segmented by the business characteristics of each issuing company. CRSP uses ICE Uniform Entity Sectors (UES) codes to assign issuing companies and their stock to the appropriate sector.

As of Monday, April 7, 2025, CRSP offices are now located at:

500 W Madison St, Ste 2900

Chicago, IL 60661

How Academic Research Shaped an Industry Standard

CRSP’s Market Indexes were built on a foundation of rigorous research—now, Chicago Booth Magazine is telling that story.

Discover how Booth faculty’s groundbreaking work led to the creation of CRSP’s investable indexes, culminating in the 2010 launch of the CRSP US Total Market Index.

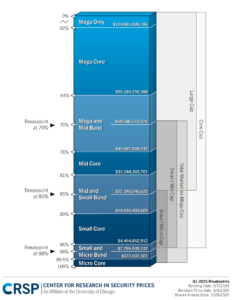

CRSP Market Indexes (CRSPMI) announces the market cap breakpoints and effective ranking dates for its March 2025 quarterly index rebalancing.

©2025 CENTER FOR RESEARCH IN SECURITY PRICES, LLC. ALL RIGHTS RESERVED.