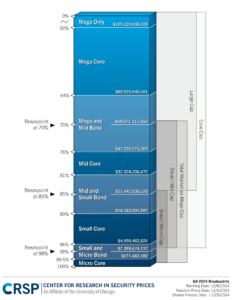

We are excited to share that CRSP’s research datasets were used in ~2,100 research papers published in 2024. Some of the most impactful include:

- Which U.S. Stocks Generated the Highest Long-Term Returns? by Hendrik Bessembinder (W.P. Carey School of Business)

- Scaling Core Earnings Measurement with Large Language Models by Matthew Shaffer (University of Southern California; University of Southern California – Marshall School of Business) and Charles C. Y. Wang; (Harvard University – Business School (HBS); Harvard University – Accounting & Control Unit; European Corporate Governance Institute (ECGI))

- Long-Run Asset Returns by David Chambers (University of Cambridge – Judge Business School), Elroy Dimson (CEPR, University of Cambridge – Judge Business School), Antti Ilmanen (European Corporate Governance Institute (ECGI)) and Paul Rintamäki (AQR Capital Management, Aalto University

- Watching the Watchdogs: Tracking SEC Inquiries using Geolocation Data by William Christopher Gerken (University of Kentucky – Finance), Steven Irlbeck (University of New Hampshire – Department of Accounting & Finance), Marcus Painter (Saint Louis University – Department of Finance) and Guangli Zhang (Washington University in St. Louis; Saint Louis University – Sinquefield Center for Applied Economic Research)

- The Power Of Price Action Reading by Carlo Zarattini (Concretum Group) and Marios Stamatoudis (Independent)

When it comes to your research, you need data you can rely on. At CRSP, we are dedicated to providing the most trusted datasets to fuel your research. Explore CRSP Research Data Products.